Government could turn to the Bank of Ghana for financing if it fails to enter the international capital market next year to issue a Eurobond, international research institution, REDD Intelligence has said.

This is despite the Bank of Ghana’s Governor, Dr. Ernest Addison, ruling out fresh loans to the government to help close the budget deficit.

Dr. Addison believed that any attempt to burden the state treasury would jeopardize the country’s exchange rate stability.

During the peak of the Coronavirus pandemic, the Bank of Ghana loaned the government ten billion dollars to help mitigate the economic impact of the virus.

The report said lack of Eurobond financing begs the question of what alternative financial options the government has to cover the budget deficit as well as pending debt maturities.

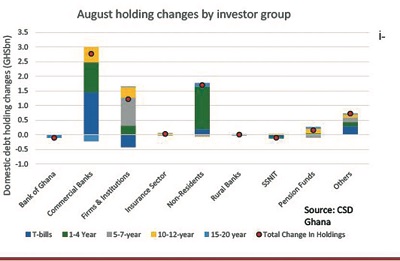

“Upcoming maturities of two-year bonds of GHS 2.0bn (USD 0.3 billion) and USD 2.4 billion (USD 0.4 billion) on 8 November and 6 December, respectively, could see a further reduction in non-resident holding of domestic debt, and weigh on Ghana’s foreign reserves if funds are repatriated,” the report on Ghana said.

“When sufficient money were not available from other creditors, the government regularly went to the Bank of Ghana (BoG) for financing, most recently from August to December last year.”

According to the international research firm, Ghana saw a record drop in non-resident holding of domestic debt in September which was connected to a two-year domestic bond which matured on 27 September this year.

The report is titled “Ghana: Eurobond sell-off puts 2022 financing at risk.”

REDD said the country faced severe financing challenges ahead of the presentation of the 2022 budget in mid-November, as a sharp sell-off in its Eurobonds brought doubts over its continued access to international capital markets financing.

“If Ghana remains closed out of the international financial market in half-year 2022 then there is an increased likelihood the government may consider applying for a debt restructuring under the G20 Common Framework. This is somewhat earlier than our previous assumption that such an application could materialise in 2023-24.”